Introduction

The global energy storage boom is increasingly defined by one upstream reality: lithium battery production is geographically concentrated, and this concentration determines the origin of many battery energy storage systems deployed worldwide. The core of any energy storage system is not the container or branding, but the upstream battery cell supply, battery modules production, and battery pack integration into industrial-scale systems.

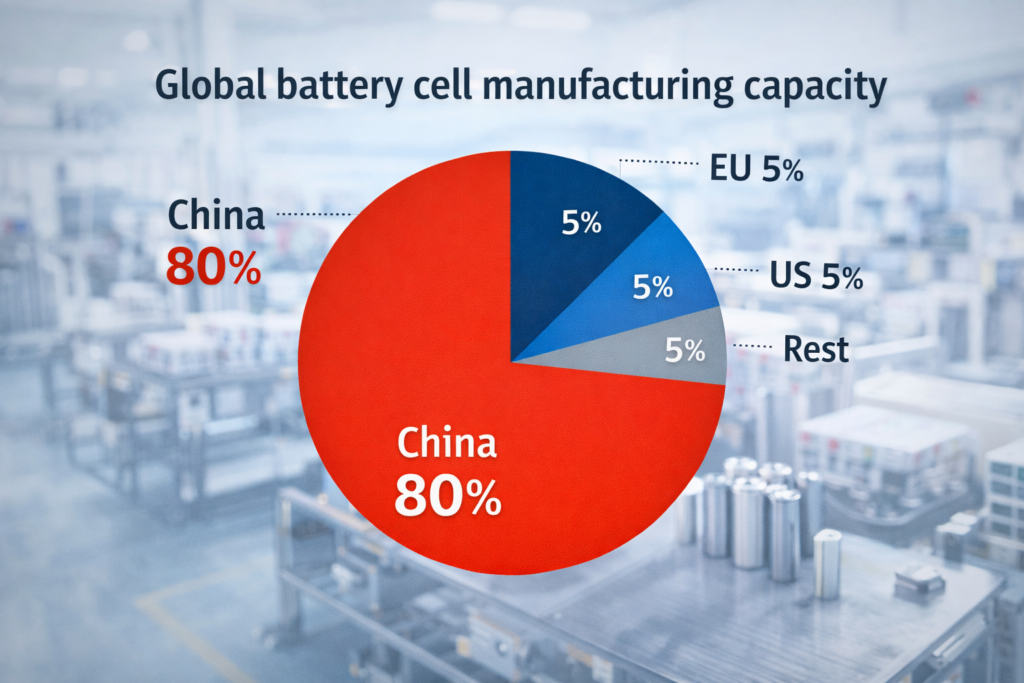

The European Parliament Research Service (EPRS) states that global battery manufacturing is highly concentrated, with China accounting for more than 80% of global manufacturing capacity for battery cells, while the EU and the US remain far behind.

The European Commission Joint Research Centre (JRC) similarly emphasizes that batteries for energy storage in Europe are tied to global supply chains rather than fully domestic production, increasing import exposure across key parts of the energy storage value chain.

China dominance in energy storage, batteries

China’s leading position is not a perception issue; it is measured. The European Court of Auditors (Special Report 15/2023) quantifies global capacity distribution and reports that China represented 76% of global battery production capacity in 2021, far ahead of the EU share.

This scale advantage translates into structural competitive advantage: access to integrated suppliers, stable production, and industrial manufacturing ecosystems capable of delivering batteries and complete systems at scale.

EPRS also notes that the battery value chain is geographically concentrated, which increases dependency on dominant manufacturing regions and reinforces supply chain power in downstream energy storage markets.

In practical terms, concentration influences pricing, cost effectiveness, and delivery reliability for energy storage solutions across the world.

Lithium battery pack production as the foundation of modern battery technology

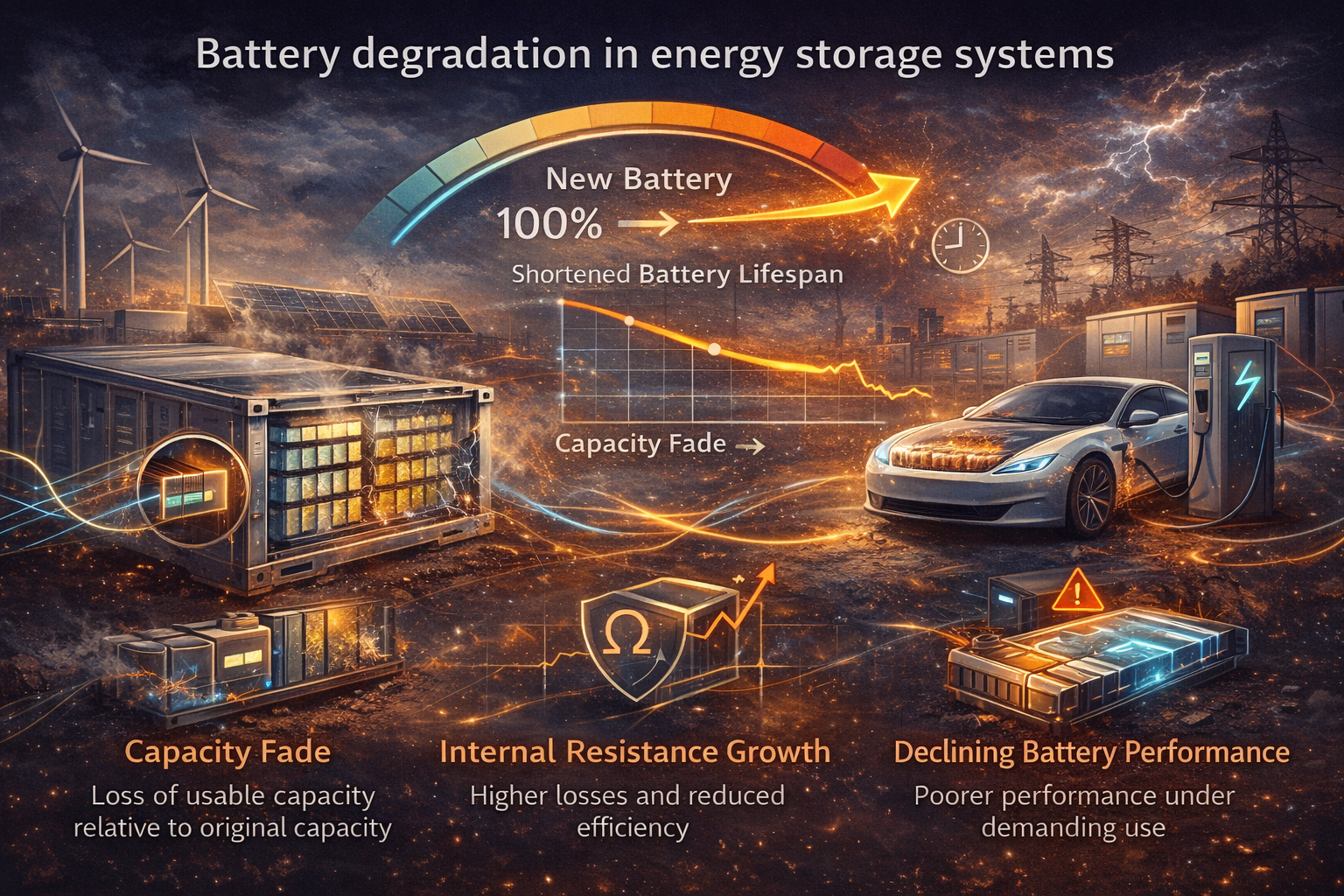

Most modern energy storage deployments are based on the lithium battery, particularly lithium ion battery technologies. Battery performance and project economics depend on upstream quality and stable supply of battery cell output, battery modules assembly, and battery pack engineering supported by quality control and operational standards.

The role of upstream dominance is explicitly highlighted in EPRS analysis: China’s leadership at the battery cell stage shapes the downstream market for batteries used in energy storage systems.

In other words, controlling lithium battery production scale means influencing cost curves and supply availability for both grid storage and industrial energy storage applications.

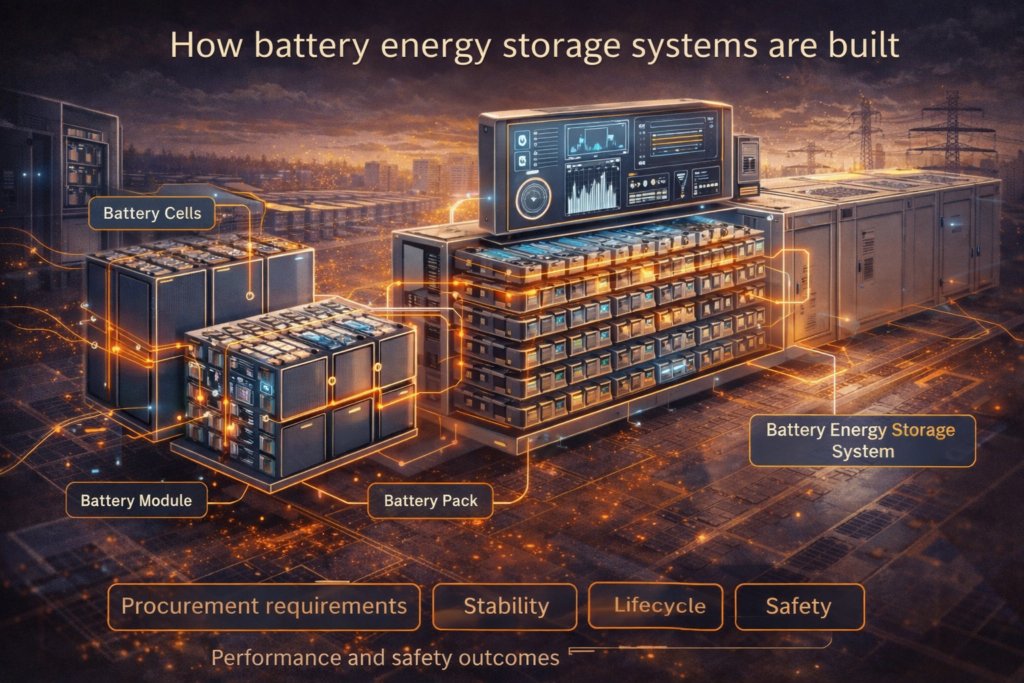

How battery energy storage systems are built

A modern battery energy storage system is a layered architecture. Battery cell groups are assembled into battery modules, which are integrated into a battery pack, monitored through advanced battery management systems, and operated under grid power requirements. These systems are procured based on measurable performance and safety outcomes: stability, lifecycle, warranty structure, and operational controls.

However, the origin of these systems is defined upstream. JRC documents that the EU battery market remains import-exposed and that most EU imports of Li-ion batteries came from China, linking European energy storage deployment to China-led cell production.

The trade picture supports this relationship. Reuters reports that Europe became the top destination for China’s battery exports, accounting for 42% of China’s total battery exports so far in 2025.

This implies that a significant share of battery components entering European energy storage supply chains is imported.

A key market consequence is that European players may assemble and integrate locally while relying on external upstream suppliers. The Financial Times, citing a study by Transport & Environment, describes the risk of Europe turning into an “assembly plant” for Chinese battery makers.

Policy signals already reflect this concern. Reuters (19 January 2026) reported that the EU is preparing draft rules requiring publicly procured battery systems to be assembled in the EU, acknowledging that upstream dependency remains a strategic issue.

Taken together, these sources indicate a clear pattern: European integrators can deliver complete battery solutions and full battery energy storage systems while upstream battery cell and battery modules supply remains structurally connected to China-dominated production.

Lithium iron phosphate and chemistry selection in energy storage

Technology and cost drivers influence which chemistries are adopted for energy storage projects. The European Commission (SETIS/JRC) materials highlight that technology and cost pressures shape deployment patterns and procurement expectations in energy storage markets.

In stationary energy storage, lithium iron phosphate is widely adopted due to safety and deep cycle performance, supporting scalable lithium battery production for storage battery demand.

Procurement requirements often reflect performance metrics such as energy density and high energy density, which affect footprint, deployment economics, and usable capacity in industrial systems. This is particularly relevant where system space is constrained and high capacity utilization is required.

Battery manufacturer ecosystem and supply chain structure

A battery manufacturer competes globally through more than product specifications. Success is tied to manufacturing scale, integrated suppliers, cost effectiveness, stable production, and consistent quality control. The European Court of Auditors notes that EU industrial competitiveness remains constrained by upstream dependence and global capacity distribution.

This helps explain why China-based ecosystems remain advantaged: high-volume production capacity and dense supplier networks enable consistent delivery of batteries for energy storage markets.

EPRS further notes that geographic concentration creates dependency risks and market power for dominant producers.

For energy storage system projects, this affects delivery reliability, warranty structure, predictable quality, technical support, and procurement risk.

Applications driving demand in the industry

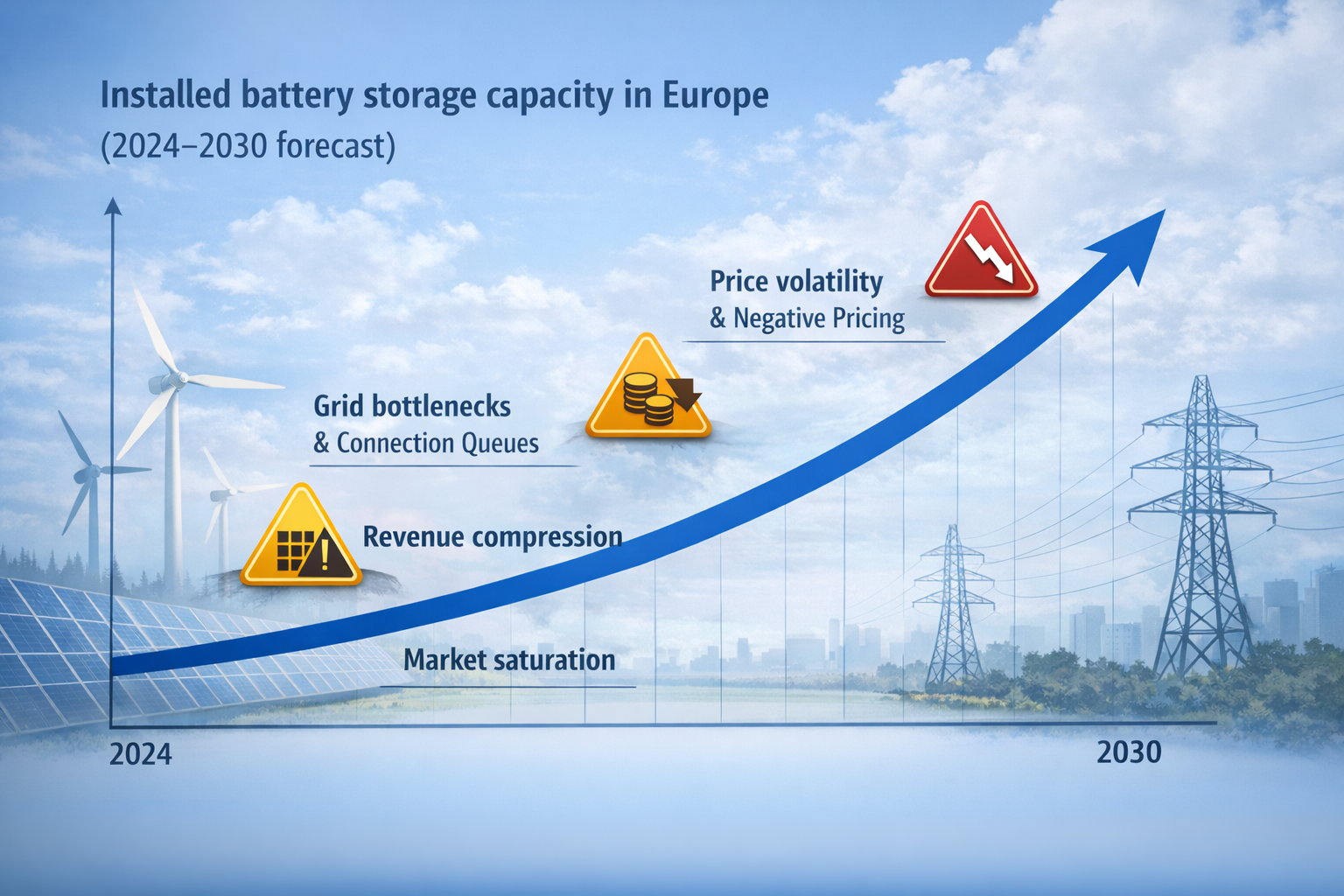

Energy storage deployment is supported by grid modernization, renewable integration, and electrification. SETIS/JRC describes energy storage as an enabling technology for power systems supporting grid stability as solar and wind expand.

This growth expands demand for battery energy storage systems in commercial applications and industrial applications, where companies increasingly require firm power capacity and resilient systems.

At the same time, China’s manufacturing dominance affects batteries availability not only for energy storage but also for electric vehicle deployment and consumer electronics, reinforcing scale advantages in lithium ion production.

This cross-market demand supports expansion in areas such as ev batteries, recreational vehicles, and golf carts where lithium battery solutions are increasingly adopted.

Safety, control, and long-term performance requirements for energy storage batteries

Energy storage procurement evaluates measurable risk. Buyers assess compliance with safety standards, thermal management, battery pack design, and advanced battery management systems to ensure reliable control and grid power delivery.

Chinese suppliers increasingly demonstrate compliance with international safety standards through third-party certification and testing pathways used in EU and global procurement. The European Commission JRC notes that batteries tested according to harmonised standards are presumed to be in conformity with regulatory safety requirements and that manufacturers can prove compliance through harmonised standards or Commission technical specifications.

This compliance is validated through globally recognised certification frameworks: TÜV Rheinland lists ESS certification pathways including IEC 62619 safety requirements and UN 38.3 transport testing for lithium batteries.

At system level, UL describes UL 9540A as a test method designed to meet stringent fire safety and building code requirements for battery energy storage systems (BESS), and such testing is widely used in project qualification.

SGS also states that international product certification awarded to Chinese renewable energy companies is a guarantee that the safety performance of their energy storage products meets the requirements of mainstream international standards.

Conclution

The evidence base is consistent across EU institutional research and market reporting. EPRS highlights that China dominates global battery cell manufacturing capacity, shaping the downstream supply of batteries used in energy storage system projects worldwide.

The European Court of Auditors confirms structural concentration: China held 76% of global production capacity in 2021.

JRC documents that most EU imports of Li-ion batteries come from China and that the EU Li-ion trade deficit reached EUR 5.3 billion in 2021, reinforcing Europe’s import exposure.

Reuters further documents the scale of this dependency and EU policy reaction through draft “made in Europe” rules for public procurement of batteries.

A research-based conclusion is therefore clear: energy storage systems in Europe may be integrated locally, but the lithium battery production base, battery cell supply, and industrial manufacturing ecosystem remain structurally tied to China.

Sources

European Parliament Research Service (EPRS), Powering the EU’s future: Strengthening the battery industry.

European Court of Auditors, Special Report 15/2023: The EU’s industrial policy on batteries.

European Commission Joint Research Centre (JRC), Batteries for Energy Storage in the European Union.

European Commission (SETIS/JRC) energy storage and battery market analysis.

Reuters, EU plans “made in Europe” rules for public purchases of green tech (19 Jan 2026).

Reuters, China battery exports: Europe top destination, 42% share in 2025.

Financial Times, Transport & Environment: Europe risks becoming an “assembly plant” for Chinese battery makers.

TÜV Rheinland, IEC 62619 / UN 38.3 certification pathways for lithium batteries and ESS.

UL, UL 9540A test method for battery energy storage system safety.

SGS, certification confirming Chinese renewable energy companies’ products meet mainstream international standards.

Related Products from Aema ESS

Explore Aema ESS energy storage solutions for backup power, grid support, and renewable energy integration.

Featured systems:

Contact us today to receive a tailored offer for your upcoming project.