Introduction

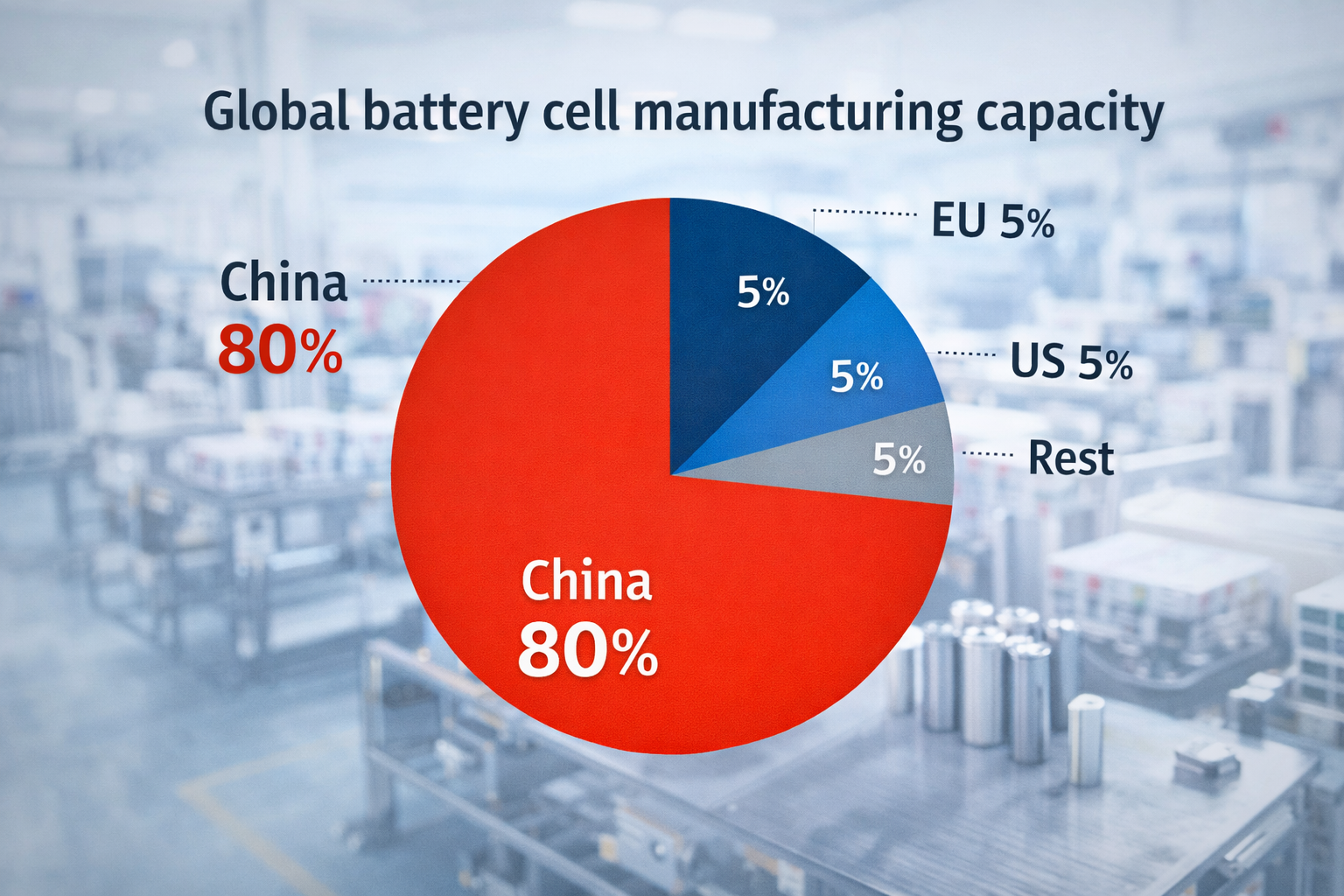

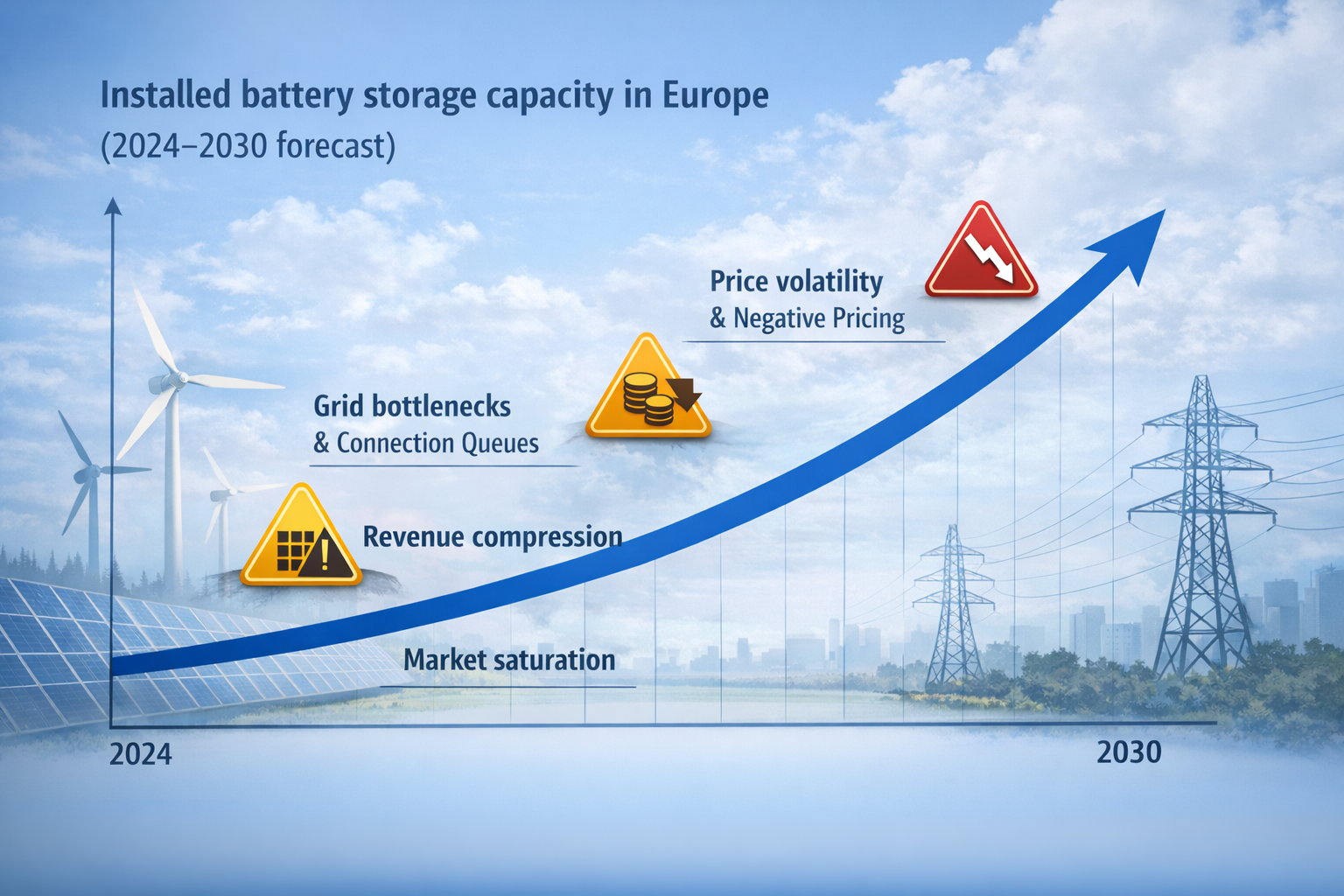

Battery storage investment in Europe is moving from a growth story to an execution story. Battery energy storage systems are still scaling fast, but market is changing how returns are earned. When more battery storage projects enter the same grid zones, they compete for the same market prices, the same ancillary services, and the same connection capacity. The result is simple: more capital, more competition, tighter margins.

Renewable energy investments are rising across Europe. Solar power and wind projects increase variability in power generation, making the energy system more volatile. That volatility supports battery storage systems value, but it also accelerates market saturation as more storage projects target the same revenue pools.

Why capital is still flowing into battery energy storage systems?

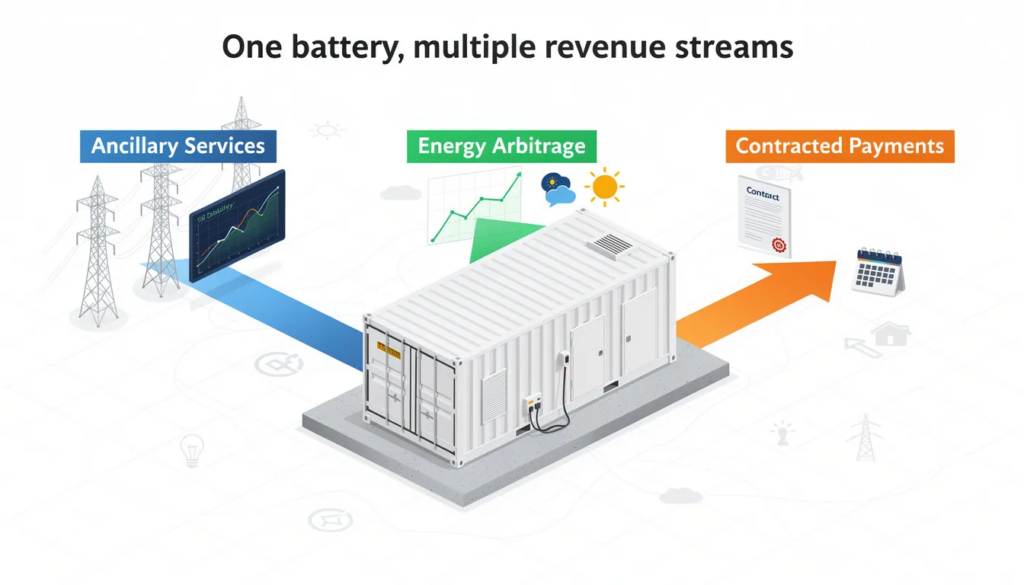

Investors like battery energy storage systems because a single asset can access multiple revenue streams. In practice, a bankable business model is one that combines ancillary services, energy arbitrage, and contracted payments where possible.

What market saturation actually looks like for investors

The problem is not “the market stops growing”. It is “too many projects chase the same revenue pools”. In saturated zones, battery storage capacity can grow faster than the monetisation space available in ancillary markets, especially if grid operators limit new dispatch profiles until upgrades are completed.

That creates the classic investor problem: financing structures were built on historical spreads and optimistic market trends, but forward returns depend on queue position, dispatch constraints, and competition for the same market prices.

Where returns compress first

Return compression typically starts where entry is easiest:

ancillary services where procurement volumes are capped

short-duration trading where many assets can copy the same strategy

congestion areas where too many storage projects attempt the same charging windows

As more battery systems enter, the clearing price can fall even when the underlying need for flexibility grows. That is why “more storage” can coexist with weaker unit economics.

Grid bottlenecks and connection queues as the real constraint

In many markets, the hardest part is no longer EPC or equipment. It is interconnection. Connection queues and grid bottlenecks can delay the point when projects begin construction, or they can force operating limits that reduce achievable revenue.

This is why “profitable battery storage” is often less about the technology and more about location, permits, and grid readiness. A project that cannot consistently deliver power at the right node will struggle, even if the broader energy storage market is expanding.

The shift toward utility-scale and large-scale battery storage

As the sector institutionalises, the competitive landscape shifts from small deployments to utility scale BESS and large scale battery storage portfolios. That changes investor expectations:

stronger system reliability requirements

stricter warranty and performance testing

more conservative downside cases for market volatility

This is also where data centers enter the picture. Data centers and other high-load users increasingly care about grid resilience and behind the meter solutions, because power demand is rising and downtime is expensive.

The practical “exit routes”: how BESS stays profitable

There are three realistic paths to keep returns viable in saturated markets.

First, revenue certainty through contracts. Investors increasingly prefer contracted structures over pure merchant exposure. That can include long-term tolling, offtake-style agreements, availability products, or a capacity investment scheme where it exists. The point is to reduce exposure to market prices.

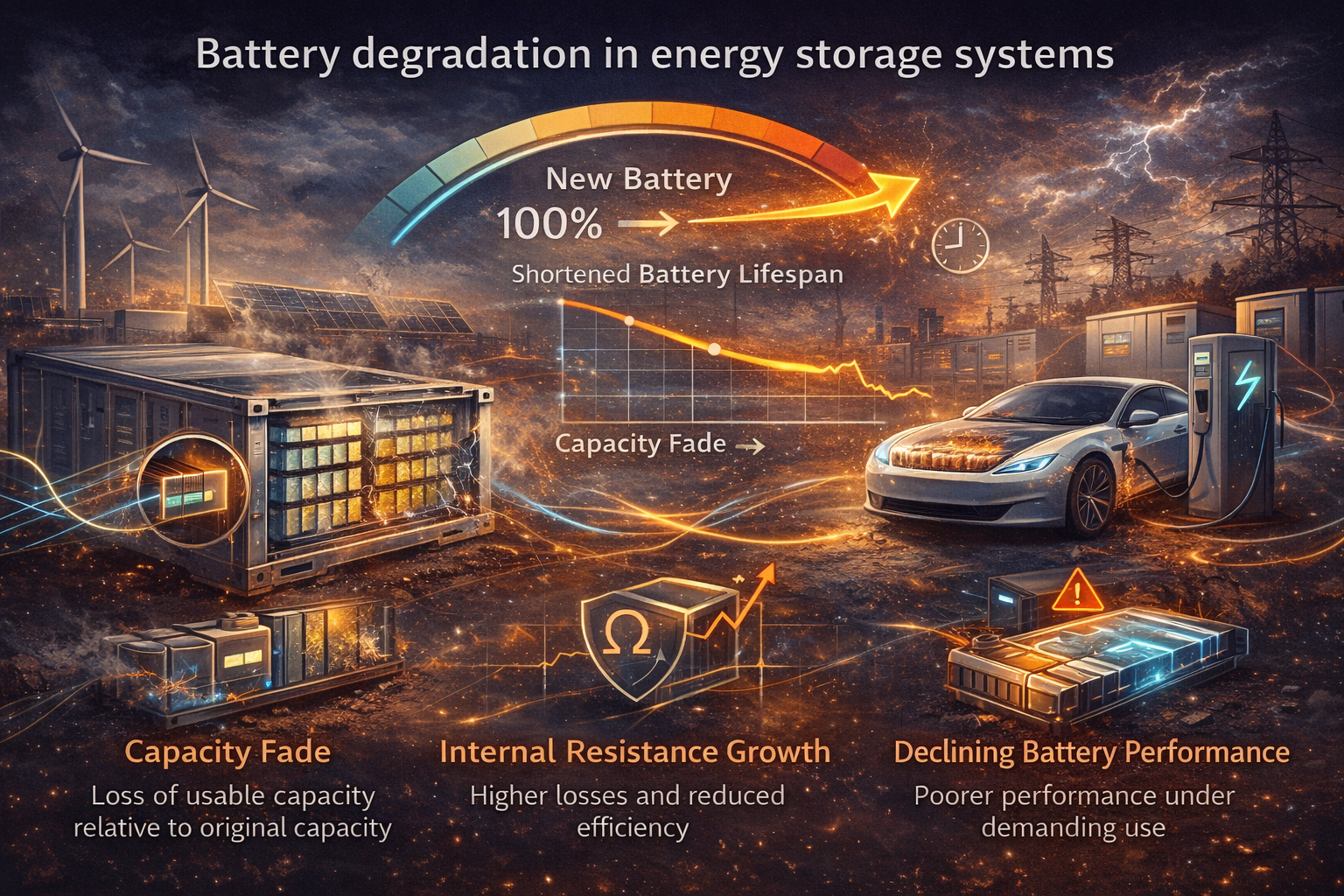

Second, operational outperformance through optimisation. The business shifts toward software, dispatch discipline, and market access. Revenue stacking still matters, but it has to be done intelligently: stacking too aggressively can increase cycling and reduce net value if degradation, curtailment rules, or dispatch limits bite.

Third, market selection and siting. The best projects are not “the biggest”, they are the ones in the right grid zones. Front of the meter assets can monetise grid services, while behind the meter projects can monetise avoided costs, peak demand reduction, and improved power quality for industrial users.

What businesses stay relevant after saturation

After market saturation, the business shifts from hardware deployment to controlling outcomes. When more storage projects enter the same market structures, returns depend on who can manage market volatility, secure grid access, and operate battery energy storage systems efficiently.

The first clear winner is asset management and optimisation. In saturated zones, the difference between an average project and a profitable one is dispatch quality. Operators that run storage projects across multiple market structures can adapt to changing market prices, prioritise ancillary services when they pay best, and switch to energy arbitrage when spreads return.

The second winner is contracting and bankability. In competitive markets, revenue certainty becomes the core product. Teams that build financing structures banks accept (hedges, tolling-style contracts, sleeves, and risk allocation) can protect projects from spread compression and reduce merchant risk.

The third winner is behind the meter. Behind the meter storage for data centers and industrial sites monetises reliability and controllable energy costs. This segment is less exposed to saturated wholesale dynamics and can support stronger long-term business model economics.

Finally, saturation creates long-term service markets. As installed battery storage grows, supply chain support becomes a profit pool: warranty management, repowering strategy, spare parts planning, and replacement scheduling.

Conclusion

Market saturation does not kill battery storage investment. It changes who wins. In a saturated energy storage market, the durable model is not “build more megawatts”. It is building projects that can secure grid access, manage risk across market structures, and monetise multiple revenue streams without relying on one easy revenue pool.

Related Products from Aema ESS

Explore Aema ESS energy storage solutions for backup power, grid support, and renewable energy integration.

Featured systems:

Contact us today to receive a tailored offer for your upcoming project.