Introduction

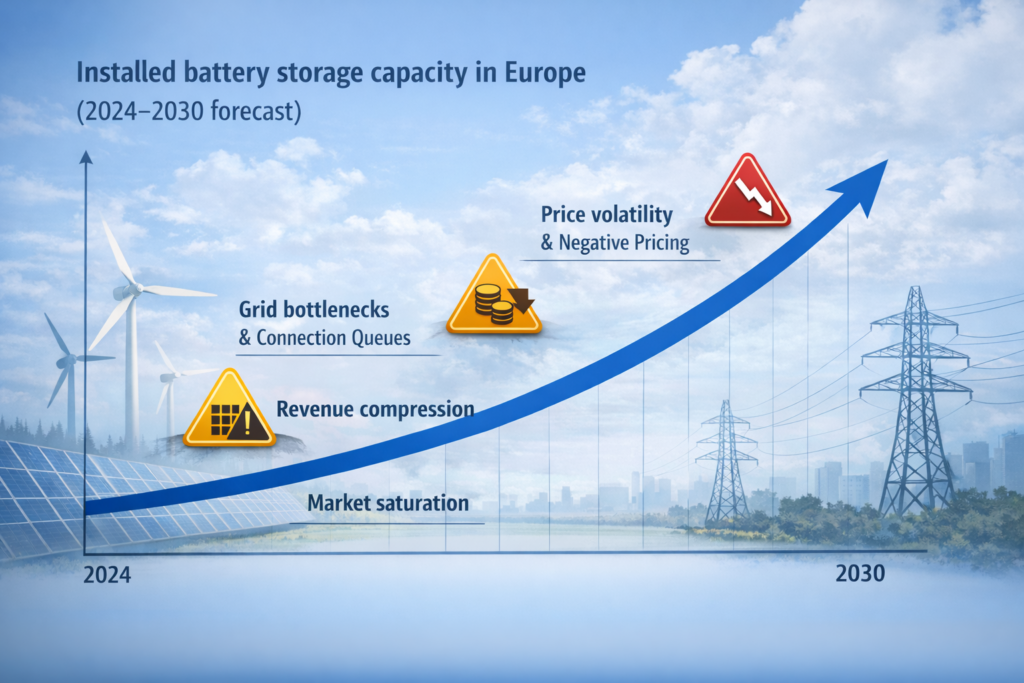

The EU “boom” in energy storage systems has moved the sector from a niche flexibility tool into a core infrastructure layer of the power system. In this new phase, the battery storage market size is no longer driven by early-mover advantage, where limited competition and high spreads supported unusually strong returns. Instead, post-“boom” market growth is shaped by structural drivers: renewable energy deployment, renewable energy integration, and the system requirement to maintain grid stability and grid reliability while meeting rising energy demands.

As per SolarPower Europe (European Market Outlook for Battery Storage 2025–2029), Europe is expected to see significant growth in battery energy storage systems during the forecast period, with a sixfold increase to nearly 120 GWh by 2029, driving total installed capacity to 400 GWh (EU-27: 334 GWh).

This matters because the energy storage market after a “boom” typically shifts from installation speed to system integration: projects must support renewable energy integration, deliver a continuous power supply during system stress, and help manage excess energy when renewables produce beyond demand.

Across the forecast period, the storage market continues to expand because energy storage is linked to strategic goals such as energy security and energy independence, not only to short-term incentives. This creates a post-“boom” environment where growth continues, but constraints and competition increase.

Battery storage market size and energy storage market growth after the "boom"

After the EU “boom”, the battery storage market size keeps growing, but the growth drivers become more structural. The EU power system is seeing rising renewable energy installations and more intermittent renewable resources, which increases the value of grid energy storage and storage systems that can shift energy across hours and provide fast response to imbalances.

As per Reuters (Feb 2025), Europe’s battery storage market is expected to see a five-fold increase in capacity by 2030, surpassing 50 GW, representing around €80 billion of investment, even though this remains below system needs estimated at 200 GW to fully support grid stability.

This is the after the “boom” signal: the market growth is large, but the system still has shortages of flexibility. That gap supports ongoing market expansion during the forecast period.

The same Reuters analysis links expansion to rising wind and solar shares and the need for backup solutions that balance intermittent supply.

That is why the energy storage system market in the EU remains tied to renewable energy projects, especially those that must manage curtailment and volatility.

Forecast period trends: market value, growth rate, and the competitive landscape

During the forecast period, the discussion around energy storage increasingly sounds like a market report: market value, market growth, and long-term compound annual growth rate assumptions. Even though not every source provides one single CAGR (Compound Annual Growth Rate) number for the EU storage market, the overall direction is clear: the global market is expanding, and Europe remains one of the fastest-growing regions due to decarbonisation and renewable buildout.

As per SolarPower Europe (2025–2029 market report), the outlook covers trends and forecasts across residential, commercial and industrial (C&I), and utility-scale battery segments, showing that the energy storage industry is rapidly shifting toward utility-scale.

That shift is a sign of maturity, but it also creates new problems after the “boom”. When projects move from small and local to large institutional portfolios, competition increases sharply. The market becomes more sensitive to grid connection queues, auction results, and long-term contracting, because these factors decide who actually gets built and who gets stuck waiting.

As per Reuters, rising price volatility and more frequent negative pricing hours in markets like Britain and Germany support battery monetisation through trading and ancillary services, while declining battery costs improve investment appeal. The downside is that lower costs and higher volatility attract more projects into the same markets, which increases competition and can compress returns.

In simple terms, this is what typically happens after a “boom”: the storage market keeps growing, but it stops being easy. Profitability concentrates in projects with strong grid access, good optimisation, and multiple revenue streams, while weaker projects struggle with connection delays, tougher auction competition, and tighter margins.

Grid operators, grid stability, and why connection capacity becomes the main constraint

After the “boom”, the biggest constraint is no longer buying batteries or building a BESS. The real constraint is getting connected to the grid. Grid operators effectively decide which projects move forward, because grid connection capacity is limited and connection queues are growing. Even if a project is financed and ready, it may be delayed for months or years simply because the grid cannot safely handle more charging and discharging at that location without upgrades.

As per Reuters (May 2025 grid article), the EU power grid requires massive upgrades to keep up with renewable deployment and rising electricity demand, and storage is repeatedly mentioned as part of the stability toolkit. This aligns with the idea that the post-“boom” energy storage market is constrained by grid readiness, not only by capital.

After the “boom” phase, this becomes a market-wide problem rather than an isolated project risk. Connection queues, grid bottlenecks, and delayed reinforcement mean that a growing share of the pipeline may remain paper capacity for extended periods, even while market demand and investment appetite remain strong.

For post-“boom” EU projects, the market is no longer only about installing batteries. Buyers and system operators increasingly require projects to support grid stability and deliver an uninterrupted power supply during stress events, because storage is now treated as a reliability asset. In other words, the battery energy storage systems market continues to grow, but grid bottlenecks and connection queues decide which projects in the pipeline become real operating assets and which remain delayed on paper.

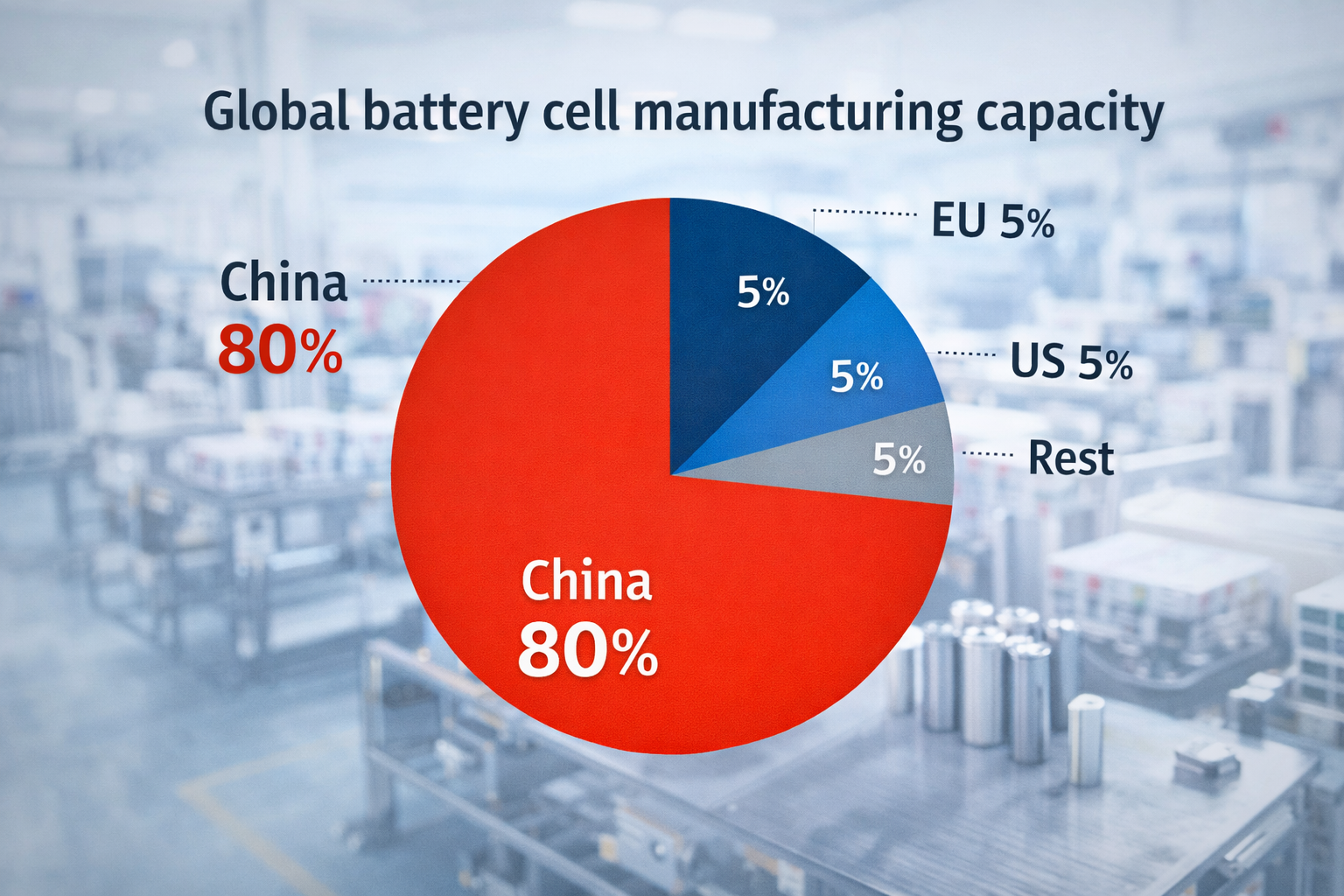

Battery technologies and vendors: how the supply side shapes the market

A post-“boom” market also changes how buyers view vendors. Once the market moves into infrastructure scale, procurement becomes more standardised, and buyers focus on bankability, warranties, and supply assurance. That is why supplier names show up in the keyword landscape: LG Energy Solution, Siemens Energy, and Contemporary Amperex Technology (CATL) are frequently referenced in discussions about bankable supply and system integration capability.

This does not mean a single company defines the market; it means the market has matured into a vendor plus integrator structure. In practical terms, a battery vendor’s position within the competitive landscape can influence project timelines, financing terms, and perceived risk during the forecast period.

Drivers that will define what happens after the "boom"

After the EU “boom”, the question is not will the market grow, but what kind of market growth. Multiple drivers shape post-“boom” outcomes.

First, renewable energy integration increases the need for storage to manage volatility, curtailment, and shifting supply patterns. Second, grid limitations and interconnection rules determine which projects connect. Third, the service stack evolves: revenue pools get more competitive as more projects chase similar opportunities.

As per Reuters, large energy players and traders are actively investing in large-scale battery projects across Europe, which is a typical sign of market confirmation and competitive intensification after the “boom”.

This is where the post-“boom” story becomes clear: as the storage market grows, competition shifts to optimisation capability, contracting structures, and system-level performance.

Conclusion

During the forecast period, the battery storage market size in Europe continues to expand, but the post-“boom” market is shaped by three core realities: grid constraints, competitive intensity, and the strategic role of storage in integrating renewables and maintaining stability.

As per SolarPower Europe (2025–2029 market report), Europe’s battery storage capacity is projected to reach 400 GWh by 2029, demonstrating significant market growth and market expansion after the “boom” phase.

As per Reuters (Feb 2025), Europe’s battery storage market is expected to surpass 50 GW by 2030, representing about €80 billion in investment, while still falling short of estimated grid needs for full stability support.

As per European Commission guidance, energy storage supports flexibility and can reduce price peaks, reinforcing that this is a structural energy transition tool, not a temporary market trend.

The practical takeaway for the post-“boom” EU energy storage market is straightforward: the strongest projects will be those that secure grid access, support system stability, and optimise across multiple market services as the competitive landscape matures.

Related Products from Aema ESS

Explore Aema ESS energy storage solutions for backup power, grid support, and renewable energy integration.

Featured systems:

Contact us today to receive a tailored offer for your upcoming project.