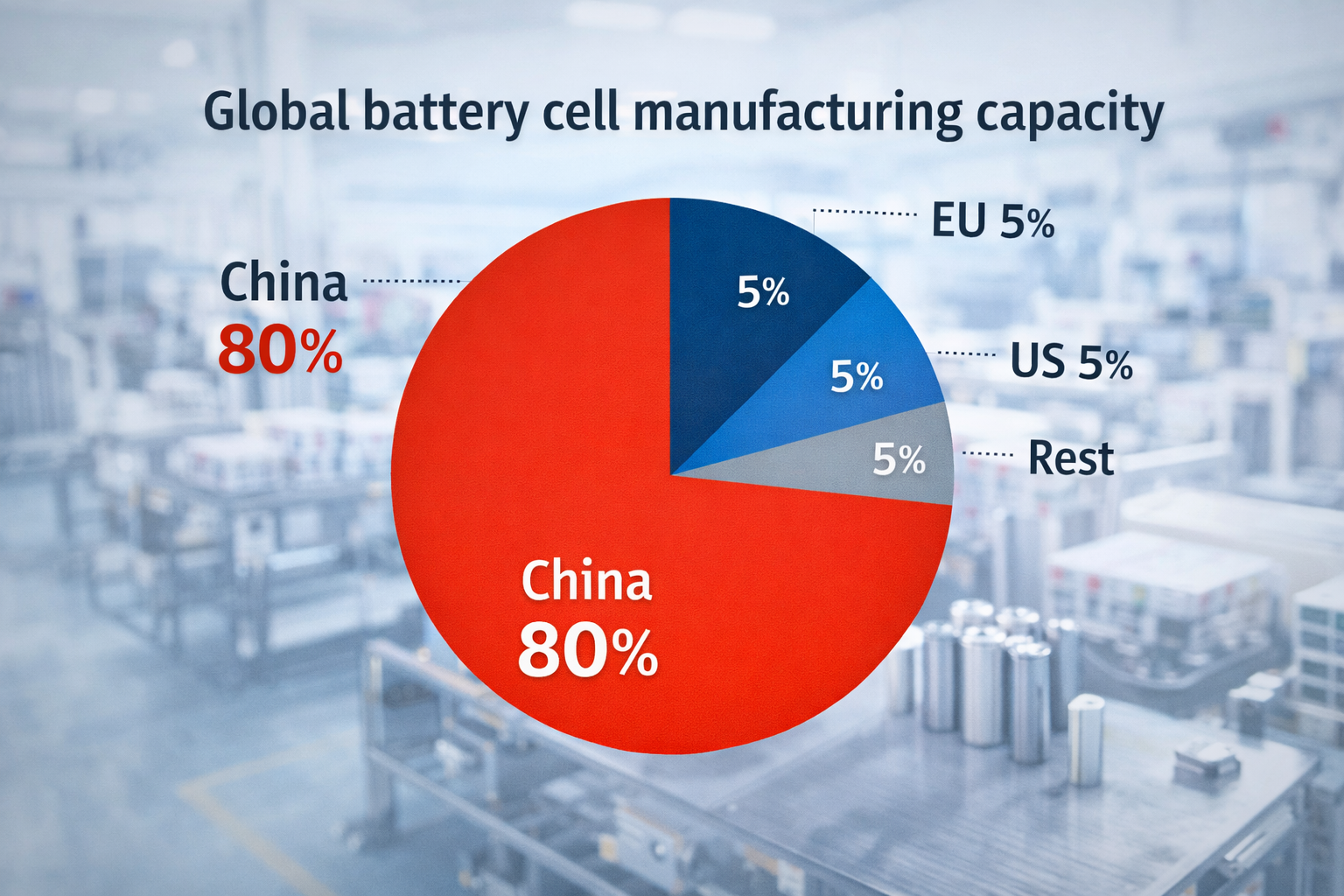

Many European companies claims to manufacture energy-storage systems. In practice, most simply assemble them. Behind the marketing lies one truth: China builds Europe’s batteries.

The European Union can call it “EU manufacturing,” but the hardware reality is shaped by China’s industrial ecosystem. China and Europe are economically linked through manufactured goods, supply chains, and foreign direct investment – and energy storage is one of the clearest examples.

EU China Relations: From Economic Cooperation to Economic Security

China–European Union diplomatic relations date back to 1975, when ties were established between the People’s Republic of China and the European Community. Over decades, China-EU relations expanded through trade dialogue, foreign affairs coordination, and climate change cooperation. But in the new stage of global competition, the EU increasingly views China as an economic competitor and systemic rival.

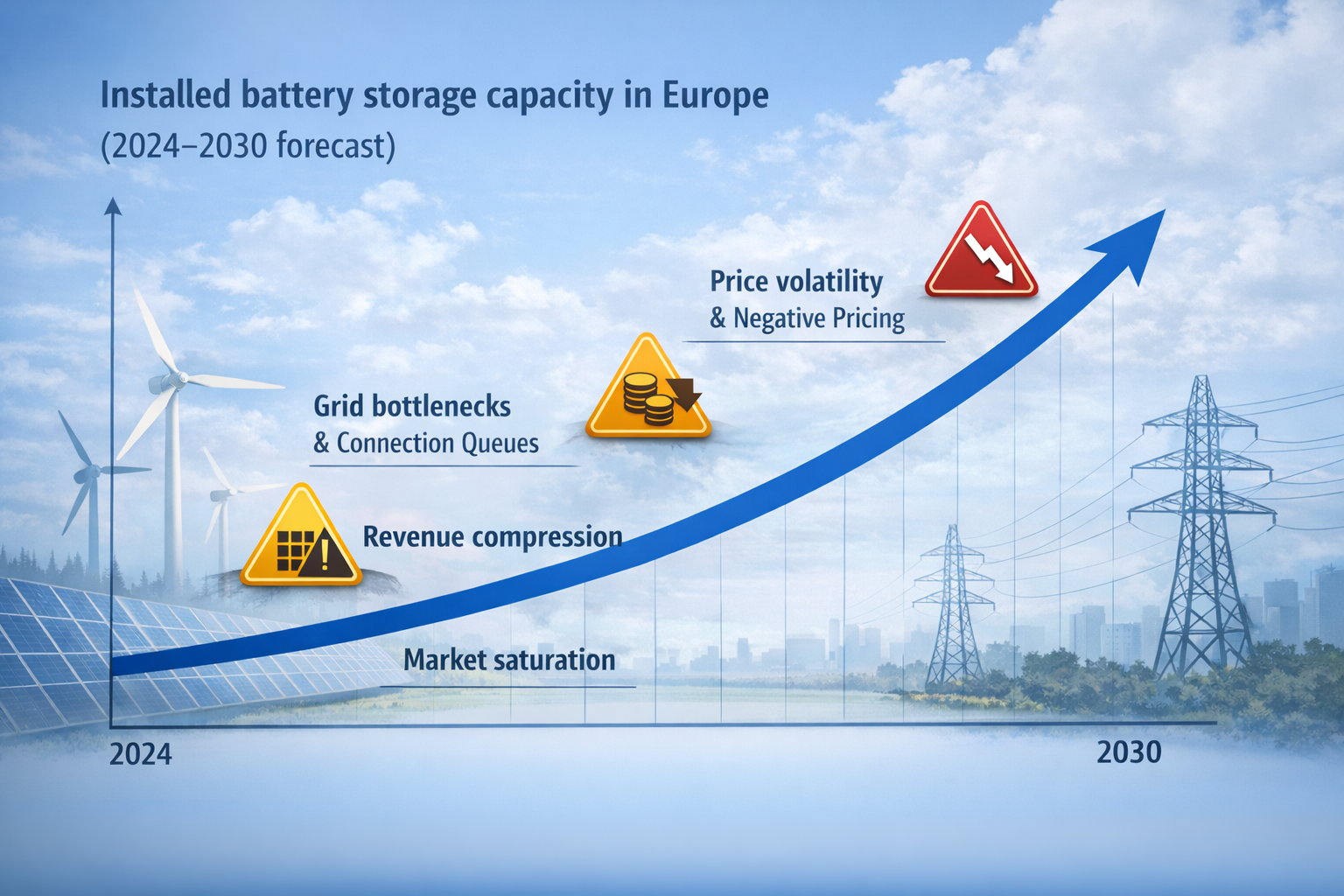

European governments and EU officials now prioritise economic security. The European Commission, European Parliament, and European External Action Service push a “de-risk” approach: reduce dependence where critical supply chains create vulnerability. This includes critical raw materials, rare earths, and strategic manufacturing.

Still, bilateral relations remain massive. EU imports from China and EU exports to China define the trade relationship. In 2024, bilateral trade in goods between China and the EU reached approximately €732 billion, underscoring the scale of their economic interdependence.

The Manufacturing Truth in Energy Storage Systems

“EU manufacturing” has become a political symbol. Yet in energy storage systems, the truth is measurable: Europe integrates, China manufactures.

European countries announce local production, but Chinese companies supply the most valuable component: battery cells. That dependency persists even when final assembly takes place in Germany, France, Italy, the Netherlands, or other EU member states.

1) European countries assembles. China manufactures.

Most “Made in EU” storage systems are final assembly lines. European companies integrate containers, racks, cooling, and control wiring – but battery modules and battery cells are typically imported from China.

The supply chain is dominated by Chinese companies such as CATL, EVE, BYD, REPT, Gotion, and CALB. These manufacturers operate at a scale Europe cannot match today. In a utility-scale system, cells are commonly 60–70% of total cost. If that core comes from China, calling the system “EU-made” is branding, not manufacturing.

For EU companies, this creates a contradiction: Europe wants industrial autonomy, but EU imports remain central to the ESS market. This dependence shapes trade deficit pressure and fuels the political debate inside EU member states.

2) Chinese quality is not a compromise

In the past, “Made in China” was framed as a threat. Today it is an engineering standard. Chinese plants run with extreme automation, traceability, batch control, and industrial discipline.

For buyers, this matters more than flags. Systems using CATL or EVE cells are built on components proven in electric vehicles and large fleets deployed globally. That performance isn’t cheap – it’s validated at scale.

3) The efficiency advantage: why EU member states depends on Chinese investment

China’s advantage is vertical integration: cathode and anode materials, electrolyte, separators, production equipment, and pack manufacturing. Chinese investment created the world’s most resilient industrial base.

This ecosystem shortens lead times and stabilises pricing. Many European storage projects stay on schedule only because the China-linked supply chain delivers. Without it, a significant share of Europe’s project pipeline would slow down.

4) The reality behind “EU factories”

Europe is building factories, but many still import electrode materials, BMS electronics, and manufacturing inputs from Asia. This is normal industrial development, but it must be described honestly.

European Commission guidance document language may focus on strategic autonomy, but production reality is different. China built dominance through industrial policy and execution. Europe is still learning that efficiency is a production metric – not a political slogan.

5) What European buyers actually need

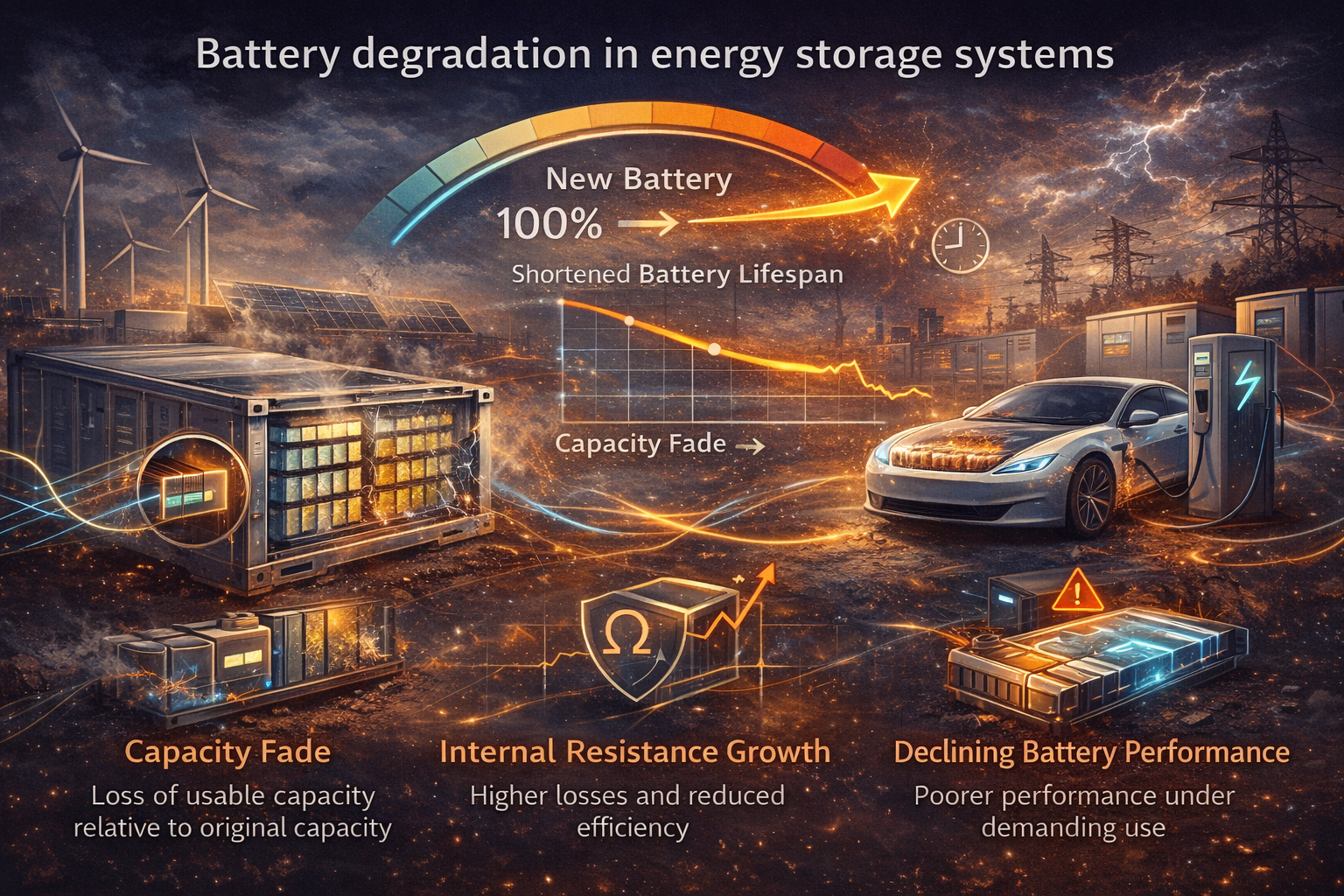

For commercial buyers, the origin debate matters only when it affects warranty, performance, and risk. Chinese-built cells tend to deliver consistency, long cycle life, and mature documentation.

European integrators add value at the system level: CE compliance, grid connection engineering, and performance guarantees. That hybrid model – China manufacturing + Europe integration – is what actually works.

6) Transparency builds trust in a de-risk world

De-risk does not mean denial. It means understanding dependencies and managing risk transparently. The EU can pursue diversification with Japan, America, and other countries, but today’s ESS market still relies heavily on China.

Transparency is respect. Buyers deserve clarity, not slogans.

Conclusion: China manufactures. Europe integrates.

China and Europe are economically bound – through trade, foreign direct investment, supply chains, and industrial capacity. Political tensions will continue, shaped by Russia, Taiwan, and global security concerns. But the ESS reality is simple: China manufactures the core, and Europe integrates the final system.

Pretending otherwise wastes time and money. Smart buyers focus on uptime, documentation, performance, and risk – not marketing labels.

Related Products from Aema ESS

Explore Aema ESS energy storage solutions for backup power, grid support, and renewable energy integration.

Featured systems:

Contact us today to receive a tailored offer for your upcoming project.